India Equity Analysis, Reports, Recommendations, Stock Tips and more!

Search Now

Recommendations

Sunday, October 15, 2006

Sizzling services send Sensex soaring

Four months to the date after the Sensex dived to sub-9,000 levels, the bellwether gauge is back to dizzy heights closing at a historical high of 12,736 points on Friday and the markets are abuzz once again.

Yet, unlike when the Sensex last touched a peak in May, the rally this time is not broad-based and is restricted to a handful of stocks in select sectors.

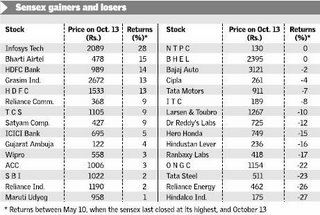

It is interesting to look at how the 30 stocks comprising the Sensex behaved between the last peak on May 10 and now.

The interim rally appears to have been driven entirely by stocks from the services sector, mainly information technology, with manufacturing taking the back seat. The momentum for the Sensex's rise was provided mainly by eight stocks of which three — Infosys, TCS and Satyam — are from the IT sector, two from telecom (Bharti Airtel and Reliance Communications) and two from the finance sector — HDFC and HDFC Bank. Grasim Industries is the sole manufacturing company stock to have registered a notable increase in value (see graphic).

Favourites flat

Market favourites such as Reliance Industries, Bajaj Auto, Maruti and Wipro have been flat while manufacturing biggies such as Tata Steel, Tata Motors, Hindalco and L&T are significantly lower than what they were trading at before the bottom fell off the market in May.

FMCG favourites Hindustan Lever and ITC, and pharma stocks Ranbaxy Labs, Dr. Reddy's Labs and Cipla are way off their peaks despite the rally in the Sensex.

Of the top five stocks in terms of market capitalisation — Reliance Industries, ONGC, Infosys, TCS and NTPC — in that order, two, that is Reliance and NTPC have been flat between the last peak and now while one, ONGC, has dropped by a sharp 22 per cent.

Infosys and TCS are the two that have gained and handsomely so.

These statistics clearly point to how narrow the rally is and, importantly, how a significant section of the market has been left out. We had in an earlier article, (Investment World September 17) when the Sensex crossed the 12,000 mark for the second time, discussed how three out of four stocks had been left out of the rally.

The situation does not appear to have changed much since.

So, what's the lookout from here on?

Valuations appear to have run up in the expectation of good earnings cards from companies in the second quarter.

Earnings numbers are the key

At current levels, PEMs are over 21 for some major stocks and they can be moderated only if earnings catch up in this quarter.

The Infosys report card seems to have enthused the market into expecting a similar performance from the other major companies that are due to come out with their numbers in the next couple of weeks.

This could be tricky because it is unrealistic and some of those expectations could be belied especially in sectors such as FMCG, metals, pharma and oil.

Second, the return of foreign funds appears to have been a major factor in driving valuations.

A temporary halt to the upward movement in interest rates in the United States and Europe as also Japan seems to have caused a resumption in fund flow to emerging markets such as India.

Of course, the rapidly expanding economy in India has also been a major factor in attracting such funds.

The direction of global interest rates would be a critical factor impinging on valuations in the domestic market; more so because the rally now is dominated by institutional investors, mainly foreign.

According to an official estimate, as much as $2.8 billion has been invested by FIIs in the domestic market since June when it hit an interim trough.

Retail investors have largely stayed away and this is an important point that should be kept in mind while assessing market prospects.

Rakesh Jhunjhunwala - (May 2006 Interview)

Rakesh Jhunjhunwala has made his fame and fortune by calling the markets right. How he has gone with a starting capital of Rs 5,000 to a net worth of a few thousand crore rupees is now the stuff of urban legend.

One of the big bulls of the stock market, Jhunjhunwala is quick to point out that he is bullish first and foremost on India's growth story. For the chartered accountant who bet big with the Madhu Dandavate budget of 1989, Bombay Stock Exchange is where it all started.

Anuradha SenGupta: It's 9 o'clock in the morning and we are outside Bombay Stock Exchange (BSE). Do you feel sentimental, when you pass by this road? This is where you started your career about 20 years ago.

Rakesh Jhunjhunwala: I can tell you Anuradha, I started here in 1985.

Anuradha SenGupta: You have been saying hello to a lot of people here.

Rakesh Jhunjhunwala: I know a lot of people here. I had no office here; I used to come here with a bag. We used to get a ticket to enter the ring. I couldn't get the permission, so I used to stand outside the ring and see trading take place. And that's how I learnt. And I remember how I struggled and how I raised money. It's a moment of great happiness. There was a samosa-wala here, right there in the garden and we used to eat samosas. Lovely samosas he used to make.

There was a bomb blast in the BSE and I was in the ring on the day of the blast. And two of the samosa-walas died here. We had 12 exits from the ring. There was such panic after the bomb-blast. And I was afraid of a stampede and kept shouting, "Don't worry, if we die, we'll die together. Don't try to save only yourself." And I saw a view in the gallery ring. Glass broke off and a person's head got cut in the ring. Very vivid and tragic memories of that day. But this street really reminds me of how I used to come here.

Anuradha SenGupta: Everyone saw how Mumbai, how the stock exchange, was back to its feet so quickly after the blast. Now is there something about making money, about trading and business that is linked with this survival instinct?

Rakesh Jhunjhunwala: You know, trading always keeps you on your feet, it keeps you alert. That's one of the reasons why I like to trade.

Anuradha SenGupta: What are these attitudes in life that you have got from your profession?

Rakesh Jhunjhunwala: First thing I've learnt is that markets work. They are the best mechanism to build societies.

Anuradha SenGupta: You are philosophical about what you do, isn't it?

Rakesh Jhunjhunwala: I am passionate, I don't know whether I am philosophical or not. I am observant surely.

Anuradha SenGupta: The India shining story, are you the face of that story, Rakesh Jhunjhunwala?

Rakesh Jhunjhunwala: Well, that's not for me to say. I entered the market at Index 150. Today, the index is at 12, 000. It's eighty times. And you know, I too could have gone abroad, I am a qualified chartered accountant. I could have practiced. It’s a fact that a person who started in 1985 in India in stock markets, could meet with success. Which speaks for the volume of opportunities available here.

Anuradha SenGupta: Today, every move you make, every investment you make, every stock you put your money on is tracked, there are people who jump into the bandwagon, whether you like it or not. Does that pressurise you?

Rakesh Jhunjhunwala: See Ma'm, I've no clients except my wife because I don't want to be answerable to anybody. But with her, I've no choice.

Anuradha SenGupta: Does it pressurise you, this performance anxiety? Like if I am a cricketer or a soccer player, and if I start performing well, there's always an expectation that every time I go into the batting field, I'll score a 100. Look at what's happening to Sachin Tendulkar?.

Rakesh Jhunjhunwala: But Ma’m, whether anyone's watching or not, I'm always paranoid about all my actions. And the likelihood of my actions being successful, say five years ago, or ten years ago or today, is only better to the extent of what better experiences I've had. I am fearless. I am not concerned about what people think. I am only concerned about my deeds.

Anuradha SenGupta: You are an icon, when it comes to someone who's successful at the stock market. Are there lot of Bunties and Bablis who want to become Rakesh Jhunjhunwala, you think?

Rakesh Jhunjhunwala: I do get mail from a lot of people, who say they want to invest in markets, and follow my career path. What did I do, they want to know.

Anuradha SenGupta: Ordinary investors, retired people. Do you think there's an understanding that they want to be educated or they just want to make a quick buck?

Rakesh Jhunjhunwala: See, markets are about money, but markets are also about knowledge. Markets are also about egos; markets are also about the satisfaction of having been proved right. Especially, when that right is from an original thought and not from a guided source or following somebody. So I feel the anxiety, curiosity and the anxiousness to know about the market; it's quite general. But markets being markets, the ability is quite limited in my opinion.

Anuradha SenGupta: Greed and fear, you said, are the two traits that have to be balanced. How does one balance them? Give us an anecdote, where you had to balance it.

Rakesh Jhunjhunwala: Anuradha, it's like this. Suppose I invest in Titan. I bought 'x' number of shares, I was extremely bullish, right? And you know, I would have been greedy if I had put in more than certain percentage of my wealth into Titan. And I didn't do it out of fear that Titan might not do well. I might lose my principal.

Anuradha SenGupta: What about ACC? You sold ACC at lot less than what it actually went on to be?.

Rakesh Jhunjhunwala: Ma’m, about markets, they say, either don't come to markets or don't regret what you have done. Right? Naya gilli, naya dao. I think the second quarter 1991 result was the best ACC produced for the next 10 years. And after those results came, I sold the shares. I bought them for 300 and within three months, I'd sold them for 3,500. And the price went to 10, 000. I've no regrets.

Anuradha SenGupta: You have no regrets, but what principle drove you at that point, fear or greed?

Rakesh Jhunjhunwala: I think I was neither being greedy nor being fearful, I was just being rational.

Anuradha SenGupta: Celebrating three years of the bull run, the BSE Index has gone from 3000 plus to 12,000 plus in just three years. And this investor says, it's going to continue that way.

Rakesh Jhunjhunwala: You know, Sensex has gone from 3000 to 12,000 in the last three years. You know people are excited, everybody's making money and that's why markets are making headlines. As they say Teji me sab ka bol bala, mandi me sab ka muh kala.

Anuradha SenGupta: Every time the markets run up, people get extremely euphoric and they get very very nervous, isn't it? And you are the guy whom they run to defend the bull run?

Rakesh Jhunjhunwala: There's no question of defending the bull run. See, we forget what markets are. Markets reflect economic truth and fundamentals. And I think India is going into a lot of unprecedented economic growth, I think the markets are only recognising that.

Anuradha SenGupta: Why is it so difficult to believe what you are saying? Why is there this fear psychosis, that if things are good, then they are bound to go bad?.

Rakesh Jhunjhunwala: I think for two reasons - past experiences and the inertia of the mind that India can have continued economic growth. And also because we've had two scams in the stock market, this also made people very suspicious of the markets. I think there is a combination of reasons.

Anuradha SenGupta: Are you saying that we should not be suspicious at all this time round?

Rakesh Jhunjhunwala: Well, I don't think there's a need to be suspicious, although I think you need to be alert. I don't think there's any scam in the market.

Anuradha SenGupta: Now, in the past, in the secondary markets, where we've seen these two scams happen, the primary market has been a safer place for retail investors. Now it looks like the primary markets are also a suspect, isn't it?

Rakesh Jhunjhunwala: Let us understand one thing that misuse of mechanisms is part of every market. All markets have to evolve. So therefore, we've to go to a stage of evolution where people are going to take advantage of the law. But law will catch up, right?

Anuradha SenGupta: You have always defended the regulator very strongly saying that the regulator is in place and that regulator systems and processes are just fine. Do you stand by that?

Anuradha SenGupta: See Ma'm, we may be critical of some mistakes that the regulator might have made, but we should realise that in the Indian stock markets, we have gone from the wild west to being one of the most modern trading system in the world. And in a very short span of time. Every regulator has to evolve. And mistakes are going to be made during evolution. So I think it's a matter of a glass being half full or half empty.

Anuradha SenGupta: Ironically, while Jhunjhunwala has all the trappings of success, he still clings to his middle-class south Mumbai roots. Proud to be a self-made man, he can’t help spouting Jhunjhunwala-isms.

Anuradha SenGupta: What I want to know, how important is it for you that people are always guessing how much you are worth? It's important, isn't it, that people don't really know?

Rakesh Jhunjhunwala: What irritates me, is how does it matter to them. And see, I am not running any relay race, I am not in any rat race with somebody and I want to be richer than somebody or I want to be the richest man. My purpose in life is to do what I enjoy and enjoy what I do, right? And wealth is a bi-product of what I do. Why do people want to know what my wealth is. How is it relevant?

Anuradha SenGupta: Maybe only because your claim to fame is the money you made on your own, the first generation from scratch starting with Rs 5,000?

Rakesh Jhunjhunwala: I think what is more needed to be appreciated is not the wealth I have as such but, how I made it. By God's grace, I am a rich man. How rich I am, how is it important? I can tell you one thing, I am rich enough for my wealth to matter internationally.

Anuradha SenGupta: You just mentioned that you are not in the rat race, how do you react when you see these lists that come out - 100 richest men in the world, 100 richest Indians, 50 most powerful Indians? Because you have figured in some, haven't you?

Rakesh Jhunjhunwala: Well, I have no press agent and I have no press agency, right? And I am not seeking any publicity. But as long as any list is a recognition of human effort and human achievement, then I would be lying if I said I don't like to be in that list. So, I like it to be there, but I am not making any special effort to be on this list. Being on the list is coincidental and not the purpose of my work.

Anuradha SenGupta: Then obviously there's no ambition to be on any other list and on higher number on any list?

Rakesh Jhunjhunwala: Not at all.

Anuradha SenGupta: You have often and emphatically pointed out that there's a lot of research, a lot of data gathering and a lot of knowledge accumulation that goes into this business of yours. What do you read?

Rakesh Jhunjhunwala: See, I read Economist and India Today, which I read cover to cover every week. In the Economist, I read the entire business section and the science and technology section. These are my constant reads. Then I read broker reports and go through balance sheets.

Anuradha SenGupta: There are five screens here, could you quickly tell us which one does what?

Rakesh Jhunjhunwala: Well, these are all of the BSE NSE live screens, where I track the prices. The first one right here is my investments. These are the futures.

Anuradha SenGupta: There are 31 scripts there?

Rakesh Jhunjhunwala: Yeah, except CL, all of them are my investments. These are all my shares in which I have some short-term positions. These are just some companies whose prices I want to follow. And these are the futures that I trade, right? This is the live Reuters screen, from where I get information. And this is the Internet. And there's the television.

Anuradha SenGupta: Can you go through a single day without having, if you want to, conversations with anybody outside.

Rakesh Jhunjhunwala: There are a certain people whose views I value, some friends with whom I discuss matters, so I talk to them. Essentially, the decisions in trading and investment are very lonely decisions. And I, of course, can trade without talking to anybody. But I do tend to talk to people.

Anuradha SenGupta: You know I have spoken to a few people, who say there's a contradiction in Rakesh Jhunjhunwala. There's this long time view he has on some shares and he stays and he stays and he stays. Hangs in there, tight. And here on his trading screen, he can make and lose 20 crores or 50 crores in a blink. As we talk, can you do that?

Rakesh Jhunjhunwala: Well, I don't do that kind of trading. I hold investments for a long time because I read somewhere and time has taught me that we should be greedy, but long term greedy. So, when you have something good, stick to it.

Anuradha SenGupta: What about the other screen?

Rakesh Jhunjhunwala: Ma'm, I had no capital when I came to the markets, and no father gifts and no father-in-law gifts. So I had to earn the capital to invest. How do you invest if you don't have the capital? And I got the capital by doing all this future trading.

Anuradha SenGupta: And you can lose and make up to how much, say as we are talking?

Rakesh Jhunjhunwala: I would not like to quote figures. I only make mistakes, which I can afford, where I can lift to begin again.

Anuradha SenGupta: You get in actually before the trends start, isn't it? For the investment decisions?.

Rakesh Jhunjhunwala: By God's grace, I think from 1985-86 to 2006, I had been able to catch most; say if there are 10 cycles in the market, then I have been able to catch 9 right. So investment wise, the cycles have been good. In trading, we make mistakes everyday. You know one author once said beautifully, that it's important that you are right or wrong in trading; it's important how much you lose when you are wrong and how much you make when you are right.

Anuradha SenGupta: If you lose money, do you feel stressed?

Rakesh Jhunjhunwala: No, never. I feel it for five minutes. Because Ma'm, I am not staking more than two or three percent of my wealth in these. I always remember Churchill's words.

Anuradha SenGupta: You've quoted Churchill. You quote very regularly. Do you read anything else that these people have written? The non-investing legends.

Rakesh Jhunjhunwala: Well, Churchill was not an investing legend at all.

Anuradha SenGupta: Exactly. So, do you read beyond the quotes that have come in the books?

Rakesh Jhunjhunwala: I am very fascinated by the Second World War. I have seen so many movies on the Second World War. I saw 25 CDs on the war and that gives you lot of quotes. Now, my non-market, non-economic reading is much lesser. I was a voracious reader before 35.

Anuradha SenGupta: Even by international standards, your good wealth is what you sell. Does that mean you are ready to trade and to invest in international markets? What's stopping you? Is it legality or is it scale?

Rakesh Jhunjhunwala: There are two to three reasons. First, even if I desire, I cannot do it because all my wealth is in India. By 2010, we will have capital ready. That's my guess. Second, the opportunity in India itself is so huge. And, so nascent. When we are getting good food at home, why think of a restaurant? And third, to invest at international scale, I need to build a bigger and broader organisation. I think I will have all the three by 2010.

Anuradha SenGupta: What in terms of capital you need to invest to be considered of a notable investor?

Rakesh Jhunjhunwala: I don't want to go into any market to be noted, I want to go there to make money.

Anuradha SenGupta: So, capital is not a limitation?

Rakesh Jhunjhunwala: No, capital is never a limitation.

Anuradha SenGupta: You work with money. To put it very simplistically, where do you save your money?

Rakesh Jhunjhunwala: Where do I save my money? Well, whatever I earn, less my expenses is my saving.

Anuradha SenGupta: Away from the stock markets, are there any areas you would save your money - art, real estate?

Rakesh Jhunjhunwala: No art really. I bought one painting last month. I have a house apart from this office, so no real estate either. I've invested in some real estate funds.

Anuradha SenGupta: So what is saving for Jhunjhunwala?

Rakesh Jhunjhunwala: My wealth is a valuable portfolio, that's my saving.

Anuradha SenGupta: Can that be notional also because today depending on the markets, it's x today and goes down tomorrow?

Rakesh Jhunjhunwala: I wouldn't say it's notional, it's fluctuating.

Anuradha SenGupta: Doesn't it bother you sometimes that you are not the guy with the ideas; you are the guy who is backing the guys with the ideas?

Rakesh Jhunjhunwala: I don't think so. There are various parts of creating anything. So when I invest in a company at an initial stage, I am handling with that company. I distinguish between my chairmanship of Aptech and my directorship of other companies. In Aptech, we are under management control of the company. So we are exactly running it.

Anuradha SenGupta: What's the experience like? For you it's a new experience, isn't it?

Rakesh Jhunjhunwala: It's a challenge, Ma'm. I don't know whether I will be successful. I will know in five years. But I love a challenge. Funds worldwide have made billions of dollars by taking over management control of companies. Now I had never taken management control of any company prior to Aptech. I think it will take 4 or 5 years. I still come to the year 2010.

Anuradha SenGupta: Is 2010 a year when a lot of things will happen to Rakesh Jhunjhunwala?

Rakesh Jhunjhunwala: Yes. I will be fifty that year.

Anuradha SenGupta: So you set a lot of milestones for yourself?

Rakesh Jhunjhunwala: I never said that. They are very flexible milestones. In a stock market, people come on CNBC and give targets. I think of targets but they are very flexible. If I succeed in reviving Aptech and we get a very good profitable company then I will get courage to buy management control of larger companies.

Anuradha SenGupta: We talked about how markets are all the time on a bull run. And when Sensex keeps climbing, there is great excitement and fear. Does it bother you that people like you are scrutinised very intently at these times?

Rakesh Jhunjhunwala: Ma'm, I am concerned about one thing. I follow the law in letter and spirit and we live in a democracy. I act in accordance with the laws in government institutions. Now if the government has a right to examine everything, whether we like it or not, we have to accept it. And that's part of life.

Anuradha SenGupta: But this suspicion that comes up every time, especially in this business, does that bother you?

Rakesh Jhunjhunwala: Not at all. Whatever I have done in life, people have looked on with suspicion. Imagine a chartered accountant in 1985 coming from a bureaucratic family, going to this stock market and standing on the streets. My father is a member of the Wellington club from 1973. I am a qualified chartered accountant. I don't think culturally I have done anything wrong. But they don't want to make me a member of Willington club. It's their choice. Initially, I used to react to this with anger. Now I react to it with maturity. People will have any opinion; time will change their opinion.

Anuradha SenGupta: If you have made your money as a trader or investor in the stock market, somehow it is not as respectable as the captains of the industry? Does that bother you? Because you are putting in huge amounts of education and knowledge to make the kind of investments you are making?

Rakesh Jhunjhunwala: Ma'm let me tell you one thing. Let me be very candid. For the kind of recognition I have got, I don't think it's not respected. It's now not respected in antique minds. If capitalism is the only method of government, then the only temples of that form of government are the stock markets. And believe me, I am not doing anything to be recognised by anybody. The recognition is incidental. I am doing what I enjoy to do.

Anuradha SenGupta: But Rakesh, it bothers you enough today to remember the incident of Willington club not giving you membership?

Rakesh Jhunjhunwala: But that maybe was 10-12 years ago when I might have felt a little pinch. Now I don't feel it.

Jhunjhunwala chooses to live in a joint family. Without the economic and emotional support of his parents, he is clear that he would not have managed to throw a conventional career to the winds. His family including his sisters and brothers are the only people who benefit from his stock tips.

Rakesh Jhunjhunwala: My dad is the person who has taught me the most in my life. And I think whatever I am in life, he has a very substantial contribution in it. He's the most democratic father. I had a curiosity and he has nurtured that curiosity.

Anuradha SenGupta: So you are not a mummy's boy; you are a daddy's boy?

Rakesh Jhunjhunwala: No, I am both mummy and daddy's boy. I am the baby of the family at 46. And the youngest tend to be both. I live with my parents and we are a very close-knit family.

Anuradha SenGupta: You have a daughter, Nishtha. I remember hearing you say that you have several challenges in front of you; the first challenge is to be able to look after your health i.e., cut down on drinking, smoking, so that you can spend a minimum of 35 years with your daughter Nishtha. How are you doing on that challenge?

Rakesh Jhunjhunwala: Well, I am just starting to work on it.

Anuradha SenGupta: What I am quoting is what I heard two years ago. And you are still trying to work on it?

Rakesh Jhunjhunwala: I think it's better late than never.

Anuradha SenGupta: You are still trying to work on it?

Rakesh Jhunjhunwala: Yes, and I will eventually.

Anuradha SenGupta: But you are talking about 2010, you are talking about Nishtha, about parents who've supported you in your career choice and with who you live today out of choice. Surely it bothers them that you are not dealing with this challenge upfront and with the kind of effort that's needed? What do you have to say to them?

Rakesh Jhunjhunwala: Well, I have no face to face them. Here I have lost a battle but I have not lost the war.

Anuradha SenGupta: Ok, Rakesh Jhunjhunwala, on one of those stock quotes. I am going to wish you all the very best in this battle. And I hope that the markets continue to rise and nobody pays a price for it.

Rakesh Jhunjhunwala: Well, that's a hope which may not be very legitimate, because in markets, some are going to win, some are going to lose. My hope would be to let India's economy prosper, let all Indians have at least basic needs. Let us build a society, which is egalitarian, where we allow people's skills to flow.

Nilkamal Plastics: Hold

Investors can retain their exposures in the Nilkamal Plastics stock, which trades at about 18 times its likely FY-07 earnings.

Nilkamal Plastics, which is among the larger players in the injection-moulded plastic business, recently moved into retailing of plastic furniture. Though the prospects for revenue growth appear bright, thin operating margins and poor returns are a cause for concern.

Nilkamal manufactures a range of plastic furniture consisting of chairs, tables and racks. This product line, which is its mainstay, accounts for 65 per cent of its revenues. The company has a significant market share of about 28 per cent in the domestic sector. Though the company faces competition from unorganised players, the geographical spread of its plants across the four regions mitigates this risk. Nilkamal also has subsidiaries in Sri Lanka and Bangladesh, allowing the company to cover much of the sub-continent. This product line, besides catering to the middle- and low-income groups, also caters to the commercial segment. Rising disposable incomes and growing acceptance for plastic furniture are expected to translate into revenue growth for Nilkamal's furniture business.

Nilkamal Plastics also manufactures crates for industrial and commercial purposes. This product line, which accounts for about 25 per cent to its revenues, caters to cola manufacturers; Coca-Cola is its key customer.

Aided by better penetration in the manufacturing and agriculture sectors, the company has reduced its exposure to the cola manufacturers. Sustained growth in the manufacturing sector is expected to translate into volume for the company's crates business.

New Forays

In 2005, Nilkamal forayed into retailing plastic furniture by opening `@ home' stores.

The company, which has six such stores, plans to open three more by the end of the year.

Though the revenue growth prospects are bright, this foray is unlikely to contribute significantly to earnings in the medium term.

The company should strengthen its position in the materials handling and storage business once its latest joint venture starts off. In April, Nilkamal entered into an agreement with Bito Lagertechnik of Germany, a leading materials handling company in Europe, to set up a 50:50 partnership. Nilkamal plans to set up a 15,000-tonne facility in Jammu and Kashmir at a cost of about Rs 40 crore to manufacture metal-based heavy-duty racks and shelves.

The company also plans to enter into real-estate development.

Financials

Nilkamal Plastics operates on thin margins, which have in turn impacted its profitability with returns shrinking to the single digit.

Though margins are likely to expand in the near term on the back of a consolidation in the plastic furniture business and dipping prices of crude oil, the company's foray into the retail sector is likely to cut down scope of expansion.

D. S. Kulkarni Developers: Buy

An established presence in Pune, which is one of the fast growing Tier-II markets; moving up the chain through high-value projects; and a comfortable land bank, augur well for D. S. Kulkarni Developers' earnings growth in the medium term.

The real-estate segment is still at a nascent stage in the domestic listed space, with a high risk-return element. Convoluted structuring of transactions has for long led to valuation discount of stocks in the sector, although the market is now undergoing a change with more norms in place.

The stage is now set for big unlisted players to make an entry. Combined with the arrival of real-estate mutual funds, this may well see the industry take on a more active role in the stock market over the long term. Investors willing to take the risks that come with an early entry in this fast-emerging space may invest in D. S. Kulkarni with a medium-term perspective. At the current market price, the stock trades at about 15 times its likely earnings for FY-07 and is at a discount to players such as Ansal Properties and Infrastructure.

The Tier-II market boom

D. S. Kulkarni has for long enjoyed a strong presence and brand recall in Pune. The Mumbai-Pune express connectivity has not only led to the city growing in the commercial and residential space, but also paved the way for it to emerge as a major IT and IT-enabled services destination among Tier-II cities.

The demand for housing would be a natural extension of increased need for office space. D. S. Kulkarni is well-placed to capitalise on the housing boom. Its recent venture into IT Parks may also act as a reference point for future projects.

Moving up the value chain

D. S. Kulkarni has a business strategy of catering to the mass-housing segment, keeping in mind low-cost housing. While this will continue to remain its primary objective, the company plans to move up the value chain with high-value projects.

Its ongoing DSK Vishwa project has a graded structure, where it would move from low- and middle-income group housing to IT parks and luxury houses and then villas. This strategy of targeting high-income clients, especially the IT-employed, who are backed by rapidly rising salaries, could improve margins steadily.

Land cushion

Apart from over 15 projects on hand, D. S. Kulkarni has about Rs 500-crore worth of land bank accumulated over years. Sitting on land purchased at relatively lower costs is likely to ensure that future projects have firm operating profit margins (OPMs). The increased supply of land through NTC mills may not affect the prices of housing projects for D. S. Kulkarni , as its construction activity still predominantly caters to the middle-income group.

This segment has valuation metrics different from the up-market projects that are likely to come up in the mill land.

Financials

D. S. Kulkarni's bottomline has grown at an annualised rate of 50 per cent over the past five years. The current projects are likely to accelerate this pace over FY07-11. The OPM at 16 per cent for FY-06 is likely to remain healthy as a result of firm realty pricing in Mumbai and Pune.

Its diversification into Bangalore and plans to enter Hyderabad, Kolkata and Tier-II cities such as Nagpur, are likely to mitigate risks of regional disparities in land regulations.

The company's debt-equity ratio appears less uncomfortable after the rights offer made early this year. With more venture capitalist companies and funds showing interest in the real-estate space, raising funds may no longer be a major task for the company.

Risks

The company's revenues may rise 150 per cent over the next couple of years, thanks to the projects on hand. However, execution delays can affect earnings growth. D. S. Kulkarni has applied for developing three special economic zones.

This segment is fraught with uncertainties such as long gestation periods and the risk of entering a new territory. The Land Ceiling Act in Maharashtra has led to real-estate companies routing land transactions through associate companies. This cumbersome practice keeps land dealings out of books and affects the transparency.

Television Eighteen: Buy

From being the operator of a monopoly business news channel, the Television Eighteen (TV 18) group has, in less than two years, expanded its share in the exploding news channel space and now operates four channels in the general and business news genres. It is better placed now than before to command higher advertising rates. It is likely to benefit from the imminent changes in the distribution set up, which could translate into higher subscription revenues.

The restructuring of group holdings that commenced last year will be completed with the listing of Network 18, the holding company that has resulted from the restructuring process.

Our last recommendation on the stock (October 30, 2005) dealt extensively with the restructuring process and the benefits that were likely to accrue. Gains from the initiative have been partly priced in. The proposed listing of Global Broadcast News (GBN), subsidiary of TV 18 and Network 18, however, offers potential for further value unlocking. TV 18 holds a 21-per cent stake in GBN, while Network 18 has a 46-per cent stake.

The stock now trades at around 22 times its likely FY-07 per-share earnings. An investment can be considered from a two- to three-year perspective.

Higher share from subscription

The implementation of the conditional access system by the year end and the emerging distribution platforms of direct-to-home (DTH) and IPTV (Internet Protocol Television) is likely to scale up contribution from subscription to total revenues, which now accounts for just about 15 per cent of operational income. The practice of under-reporting of subscriber bases by local cable operators has resulted in broadcasters getting a lower share of overall subscription revenues. While a cap of Rs 5 has been fixed on channel prices, the new regulations propose that broadcasters receive 45 per cent of the subscription revenues. This augurs well for TV 18, as both its business news channel, CNBC TV 18, and Awaaz, its Hindi consumer-oriented channel, are pay channels. Its strong presence in the business news space is likely to ensure that it remains in the choice set for most investors.

Higher contribution from subscription will reduce the influence of a slowdown in advertising revenues over the long term. However, a buoyant trend in advertising remains a critical revenue driver in the medium term.

Greater clout in advertising

Through CNBC TV18 and Awaaz, TV 18 reaches affluent viewers in the investing community, which makes it a target for advertisers. With interests in CNN IBN and IBN7 (Channel 7, re-christened by GBN post acquisition), it is well placed to command better rates from advertisers by offering them package deals. CNN IBN has also made a mark in the general news space; NDTV, however, remains the dominant player.

TV 18 reaches a large community of viewers through its web initiatives, which has the potential to offer attractive solutions to advertisers.

A slowdown in advertising spends is a high risk to earnings performance and, therefore, our recommendation.

New forays

TV 18 appears to be sold on the idea of convergence of television, the Internet and the mobile media. Internet portals now account for about 10 per cent of revenues. Its contribution to revenues and profits is likely to increase, given its aggressive expansion in this space.

In recent months, TV 18 has acquired stakes in a number of Internet portals, such as JobStreet.com and Cricketnext.com and recently announced a new subscription based portal — Indiaearnings.com, which would offer results updates, management interviews and conference calls to members. Such websites have the potential to lock- in viewers to its channels.

TV18 intends to transfer all its portals to Web18, a subsidiary. That it has raised $10 million from a private equity firm to fund investments in this business reflects its seriousness in expanding in this space.

Other new initiatives include a foray into film production and a possible launch of a Home Shopping channel, which suggests that the company is broadening its interests in the media business. The success of these forays is uncertain, but they are unlikely to make much of a contribution to revenues in the medium term.

Hexaware Technologies: Buy

Investors with a penchant for risk and a one-year perspective can consider taking exposure in the Hexaware Technologies (Hexaware) stock in the run-up to its third-quarter earnings announcement on October 19. At the current price, the stock trades at a multiple of 18 times its likely calendar year 2006 per share earnings.

As technology stocks have rallied in the past quarter, investors need to temper their return expectations and utilise any broad market declines to step up exposure. The sustained traction in PeopleSoft revenues in the latest quarter, the healthy client additions and the robust second quarter performance lend confidence to the stock.

However, the risks to our recommendation are the high client concentration/client replacement risk among its top five clients, the unexpected slowdown in PeopleSoft revenues on account of restructuring by Oracle, and the pressures from high salary inflation and attrition for a mid-cap stock vis-à-vis frontline stocks.

Hexaware's core business model is its positioning as a niche software services provider of PeopleSoft suite with specialisation in the HR services domain, apart from addressing the airlines/transportation vertical and the German geography.

Established by the company in 2002-03, this model has been broad-based to include SAP and Oracle-related services in package implementation and an expanded focus into major European markets beyond Germany. While enterprise packages accounted for 32.6 per cent of its revenues, Europe contributed 26.5 per cent in the second quarter ended June 30, 2006.

In March, Hexaware also entered into an agreement with General Atlantic LLC, under which the latter invested Rs 300 crore through a preferential allotment of equity and optionally convertible preference shares.

The turbulent phase...

Hexaware's financial performance went through a turbulent phase in 2005 and early 2006. After clocking double-digit revenue growth for seven straight quarters till December 2004, the company faltered in March 2005 and went into a serious decline for almost a year. Two key factors contributed to this drop in financials. One, following the PeopleSoft-Oracle merger, Hexaware, which was running an India Services Centre for PeopleSoft, set up under the BOT model since 2003, had to transfer this centre to Oracle with effect from November 2005.

About 13 per cent of Hexaware's revenues were derived from the PeopleSoft ISC. Two, in July 2005, Hexaware had to sharply scale down its financial guidance on account of "unexpected delays in project ramp-ups in recent months and sluggish revenue growth from new clients."

... and the recovery

For Hexaware, revenues from PeopleSoft were derived both as a partner and competitor. Out of a third of revenues contributed in 2005, 13 per cent came from the PeopleSoft ISC and the rest was derived directly as PeopleSoft's implementation partner. Since PeopleSoft's acquisition by Oracle, the future of PeopleSoft implementation has been uncertain.

Since then, clarity has emerged on the PeopleSoft front. Oracle has committed that it will support PeopleSoft customer installations until 2013 and recently also released the latest version of PeopleSoft suite in the market.

As one of the largest vendors in India for PeopleSoft, Hexaware still services under one per cent of the installed base for PeopleSoft and the potential for scale-up is fairly significant from this level. In the second quarter-ended June 30, 2006, the company reported a 17.4 per cent growth in revenues on a sequential (quarter-on-quarter) basis, with this service offering continuing to power its growth.

On the new client additions front, out of 15 clients added in the second quarter of 2006, four were on PeopleSoft platform, with the balance from other verticals such as BFSI and transportation, among others. With the uncertain variables behind it, Hexaware's revenue and earnings visibility may be stronger than in the past.

Key growth drivers

A look at Hexaware's performance over the past three quarters reflects the following drivers of growth:

In the second half of 2006, Hexaware is likely to enhance its operating profit margins through higher offshore contribution, lowering its sales, general and administrative expenses (to at least 20 per cent of revenues compared to 21 per cent in the latest quarter) and improved employee utilisation.

In the quarter ended June 30, 2006, Hexaware's operating profit margins fell by 1.3 percentage points to 12.6 per cent on account of the annual salary hike and higher visa costs.

But in the third quarter, the company has projected a sequential earnings growth of 10 per cent (on revenue growth of 5 per cent), which will be dictated by enhanced operating margins.

The company has created a separate sales organisation for "hunting and farming" of new and existing clients. The management has claimed that by farming (or cross-selling) smartly among its existing clients, it will be able to enhance revenues from its top clients.

Between the first and second quarter of 2006, Hexaware added five clients in the $1-million revenue bracket taking the total to 36. And, as of the latest quarter, Hexaware had 141 clients, with 40 belonging to the Fortune 500/Global 500 category.

Infosys Technologies: Buy

Investors with an appetite for risk may consider an exposure in small lots in the Infosys Technologies stock. The stock is trading at a multiple of 31 times its projected FY07 per-share earnings and 25 times its likely FY08 earnings (assuming a 30 per cent growth rate).

As the stock has run up by nearly 10 per cent since its earnings announcement, investors need to temper their return expectations to 10-15 per cent over a one-year perspective. Moreover, as a key Sensex constituent, with a significant weightage, the stock's appreciation is likely to be far more sedate than over the past few months.

We have `buy' recommendations outstanding on this stock at Rs 1,400 in mid-June and Rs 1,650 in mid-July. As growth stocks such as Infosys have low tolerance for earnings disappointment, investors with exposure at considerably lower price levels can use every uptrend to lock into gains on part of their holdings. A strong mid-teen growth in revenues and earnings for two consecutive quarters, all-round improvement in operational metrics and an upward revision in financial guidance for FY07 sustain its reputation as one of the better picks among frontline technology stocks.

Robust revenue growth from both its top client and those in the top five, strong increase in the number of clients across the entire order pipeline between $5 million and $50 million and offshore billing rates perking up by 1.1 per cent after a flat trend seen in the past five quarters are all pointing towards a blockbuster year.

Strong growth across all verticals, especially financial services and telecom; sharp rise in contributions from service offerings such as package implementation, testing, consulting and business process management; double-digit growth across geographies; and record employee additions in the latest quarter also bolster the positive outlook.

The risks to our recommendation are an unexpectedly sharp slowdown in the US affecting offshoring by its top-10 clients, competitive threat from multinationals such as IBM and Accenture, sustaining its growth in new service offerings and a strong appreciation in the rupee against the dollar in the coming months.

Subscribe to:

Comments (Atom)