Four months to the date after the Sensex dived to sub-9,000 levels, the bellwether gauge is back to dizzy heights closing at a historical high of 12,736 points on Friday and the markets are abuzz once again.

Yet, unlike when the Sensex last touched a peak in May, the rally this time is not broad-based and is restricted to a handful of stocks in select sectors.

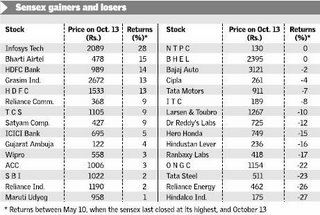

It is interesting to look at how the 30 stocks comprising the Sensex behaved between the last peak on May 10 and now.

The interim rally appears to have been driven entirely by stocks from the services sector, mainly information technology, with manufacturing taking the back seat. The momentum for the Sensex's rise was provided mainly by eight stocks of which three — Infosys, TCS and Satyam — are from the IT sector, two from telecom (Bharti Airtel and Reliance Communications) and two from the finance sector — HDFC and HDFC Bank. Grasim Industries is the sole manufacturing company stock to have registered a notable increase in value (see graphic).

Favourites flat

Market favourites such as Reliance Industries, Bajaj Auto, Maruti and Wipro have been flat while manufacturing biggies such as Tata Steel, Tata Motors, Hindalco and L&T are significantly lower than what they were trading at before the bottom fell off the market in May.

FMCG favourites Hindustan Lever and ITC, and pharma stocks Ranbaxy Labs, Dr. Reddy's Labs and Cipla are way off their peaks despite the rally in the Sensex.

Of the top five stocks in terms of market capitalisation — Reliance Industries, ONGC, Infosys, TCS and NTPC — in that order, two, that is Reliance and NTPC have been flat between the last peak and now while one, ONGC, has dropped by a sharp 22 per cent.

Infosys and TCS are the two that have gained and handsomely so.

These statistics clearly point to how narrow the rally is and, importantly, how a significant section of the market has been left out. We had in an earlier article, (Investment World September 17) when the Sensex crossed the 12,000 mark for the second time, discussed how three out of four stocks had been left out of the rally.

The situation does not appear to have changed much since.

So, what's the lookout from here on?

Valuations appear to have run up in the expectation of good earnings cards from companies in the second quarter.

Earnings numbers are the key

At current levels, PEMs are over 21 for some major stocks and they can be moderated only if earnings catch up in this quarter.

The Infosys report card seems to have enthused the market into expecting a similar performance from the other major companies that are due to come out with their numbers in the next couple of weeks.

This could be tricky because it is unrealistic and some of those expectations could be belied especially in sectors such as FMCG, metals, pharma and oil.

Second, the return of foreign funds appears to have been a major factor in driving valuations.

A temporary halt to the upward movement in interest rates in the United States and Europe as also Japan seems to have caused a resumption in fund flow to emerging markets such as India.

Of course, the rapidly expanding economy in India has also been a major factor in attracting such funds.

The direction of global interest rates would be a critical factor impinging on valuations in the domestic market; more so because the rally now is dominated by institutional investors, mainly foreign.

According to an official estimate, as much as $2.8 billion has been invested by FIIs in the domestic market since June when it hit an interim trough.

Retail investors have largely stayed away and this is an important point that should be kept in mind while assessing market prospects.